November 3 was a historic night for legalization across the country. Only a decade ago, cannabis was illegal for nonmedical use in all 50 states. Now, the tide has turned, and every presented cannabis-related initiative has passed, pushing the U.S. adult use cannabis market to 15 states with a population of over 110 million. If nothing else, this year’s election results provided clarity that American voters have become more open to the benefits of cannabis.

Here’s a list of states that passed cannabis-related measures in the 2020 election, along with an analysis of each initiative and what it means for the future:

Here’s a list of states that passed cannabis-related measures in the 2020 election, along with an analysis of each initiative and what it means for the future:

New Jersey: Public Question 1

New Jersey’s ballot proposed and ultimately passed the measure Public Question 1, making it the first Mid-Atlantic state to legalize adult use cannabis.

Expected to take effect January 2021, this measure legalizes the adult use of cannabis for anyone over the age of 21 along with cultivation, processing, and retail sales. The Cannabis Regulatory Commission oversees the state’s medical cannabis industry and will now be responsible for the new adult use cannabis market. However, since the ballot measure didn’t outline many details, it has left a lot of discretion up to the state’s legislature, leaving residents awaiting specifics about home-grow rules, possession limits, and other retail regulations.

Expected to take effect January 2021, this measure legalizes the adult use of cannabis for anyone over the age of 21 along with cultivation, processing, and retail sales. The Cannabis Regulatory Commission oversees the state’s medical cannabis industry and will now be responsible for the new adult use cannabis market. However, since the ballot measure didn’t outline many details, it has left a lot of discretion up to the state’s legislature, leaving residents awaiting specifics about home-grow rules, possession limits, and other retail regulations.

Public Question 1 will apply the state sales tax of 6.625 percent. However, under this measure, the local jurisdictions are permitted to implement an additional 2 percent, so the final tax rates remain undecided. With New Jersey’s nearly 8.9 million residents, it’s projected to have adult use sales of around $375 million in just the first year and estimated to reach up to $900 million by 2024.

Mississippi: Initiative 65 & Alternative 65A

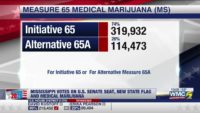

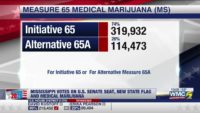

Mississippi had two competing measures on the ballot to legalize cannabis for medical purposes: Initiative 65 and Alternative 65A. Initiative 65 prevailed with 74 percent of the vote.

Between 2018 and 2019, over 228,000 Mississippi residents signed a petition that led to Initiative 65 appearing on the ballot. And by mid-2021, the legalization of medical cannabis is expected to take place. This initiative is designed to allow medical cannabis treatment for people with at least one of 22 specified qualifying conditions, including ALS, post-traumatic stress disorder (PTSD), epilepsy and Parkinson’s disease. The passage of the initiative allows those patients to possess up to 2.5 ounces of cannabis at one time with a cannabis sales tax set at the state’s regular sales rate of 7 percent.

Between 2018 and 2019, over 228,000 Mississippi residents signed a petition that led to Initiative 65 appearing on the ballot. And by mid-2021, the legalization of medical cannabis is expected to take place. This initiative is designed to allow medical cannabis treatment for people with at least one of 22 specified qualifying conditions, including ALS, post-traumatic stress disorder (PTSD), epilepsy and Parkinson’s disease. The passage of the initiative allows those patients to possess up to 2.5 ounces of cannabis at one time with a cannabis sales tax set at the state’s regular sales rate of 7 percent.

The Mississippi Legislature proposed the competing ballot item, Alternative 65A, in what supporters of Initiative 65 believed was an effort to confuse voters. This measure restricted the use of cannabis to only terminally ill patients but did not specify qualifying conditions, possession limits or a tax rate leaving the results somewhat ambiguous with many details to be set by Mississippi Legislature. Initiative 65 easily won over the alternative with nearly 74 percent of voters approving versus just over 26 percent for Alternative 65A.

Montana: I-190 & CI-118

Montana became the 14th state to legalize adult use, passing both cannabis-related initiatives on the ballot: Initiative 190 (I-190), which creates a legal adult use cannabis market, and Constitutional Initiative 118 (CI-118), which supplements I-190, allowing the state to establish the legal purchasing, consumption or possession age of 21.

These ballot issues will go into effect beginning January 2021. Initiative I-190 legalizes the adult use and possession of up to one ounce of cannabis or 8 grams of concentrate. It also allows individuals to cultivate up to four cannabis plants and four seedlings in their residence.

Depending on the circumstances, anyone serving cannabis-related sentences for reasons no longer considered crimes under I-190 may request to be resentenced or have their conviction expunged.

Cannabis and infused product retail sales will be taxed at 20 percent. Following the Montana Department of Revenue’s deduction of administrative costs to enforce the measure, remaining tax revenue is set to be allocated to the state’s general fund, veterans programs, conservation programs, drug addiction treatment programs, and local law enforcement and healthcare workers.

South Dakota: IM-26 & CA-A

South Dakota made history as the first state to legalize both medical and adult use in the same election, moving from total prohibition to legalization in just one night. First came Initiated Measure 26 (“IM-26”), South Dakota’s medical cannabis ballot item, passing with nearly 70 percent of the vote. Then came the adult use initiative, Constitutional Amendment A (CA-A), narrowly passing with almost 54 percent of votes.

Both ballot issues are set to go into effect on July 1, 2021. IM-26 establishes a medical program for individuals with a physician-certified debilitating medical condition. Patients can possess a maximum of three ounces of cannabis and, for patients registered to cultivate at home, they will be permitted to grow up to three plants at minimum unless otherwise prescribed by their physician. However, under this measure, the Department of Health can limit the number of cannabis products each person may possess and make amendments to the conditions qualified as debilitating.

Both ballot issues are set to go into effect on July 1, 2021. IM-26 establishes a medical program for individuals with a physician-certified debilitating medical condition. Patients can possess a maximum of three ounces of cannabis and, for patients registered to cultivate at home, they will be permitted to grow up to three plants at minimum unless otherwise prescribed by their physician. However, under this measure, the Department of Health can limit the number of cannabis products each person may possess and make amendments to the conditions qualified as debilitating.

CA-A legalizes the adult use of cannabis for adults age 21 and older, allowing possession or distribution up to one ounce, and for those living in a jurisdiction with no licensed retail stores, permitting the growth of up to six cannabis plants in a private residence. This measure also requires the state to adopt hemp laws.

Marijuana sales will be taxed at 15 percent under Amendment A, estimating revenue of $29.3 million by 2025. After any revenue is used for costs associated with implementing this measure, remaining revenue will be divided between public schools and the state’s general fund.

Arizona: Prop 207

On November 3, voter initiative Proposition 207 passed with 60 percent of the vote, and Arizona became the 13th state to legalize adult use cannabis – a movement that’s expected to make a great addition to the state’s already thriving medical cannabis program.

Also known as the Smart and Safe Act, this initiative legalizes the possession and use of cannabis for residents age 21 and older. It requires the Department of Health and Human Services to develop the rules regulating businesses in areas like licensing of retail stores, and production and cultivation facilities. Individuals will now be allowed to grow up to six plants in their private residences, with no more than 12 plants per household.

Also known as the Smart and Safe Act, this initiative legalizes the possession and use of cannabis for residents age 21 and older. It requires the Department of Health and Human Services to develop the rules regulating businesses in areas like licensing of retail stores, and production and cultivation facilities. Individuals will now be allowed to grow up to six plants in their private residences, with no more than 12 plants per household.

Prop 207 placed a 16 percent excise tax on cannabis sales in addition to the state’s 5.6 percent, totaling a 21.6 percent tax. It is estimated that legal cannabis will generate $300 million in revenue, which will be divided between community college districts, municipal police, sheriff and fire departments, fire districts, highway funds and a new Justice Reinvestment Fund. This initiative also allows anyone convicted of certain cannabis-related crimes like possession, consumption, cultivation or transportation to petition for the expungement of their record beginning July 2021.

Each of the initiatives above is expected to provide a wealth of job opportunities and economic growth for their state. This transition also allows those in the cannabis law and regulation industry the chance to develop and implement meaningful and accessible social equity licensing programs. In addition to day-to-day business needs, our firm will be working closely with clients as they transition from strictly medical cannabis licenses to dual licensing. We will also help new licensees build out and develop their adult-use licenses with long-term success in mind.

Cannabis has quickly become a mainstream health and wellness solution for people all across the globe. With the estimated annual national market for cannabis being $50-$60 billion, it’s believed to be a real solution to many local economic shortfalls caused by COVID-19, opening up the country and cannabis industry to a whole new world of opportunity.

Following the news of the merger, Tilray’s stock rose more than 21% the same day. Once the reverse-merger is finalized, Aphria shareholders will own 62% of the outstanding Tilray shares. That is a premium of 23% based on share price at market close on the 15th. Based on the past twelve months of reports, the two companies’ revenue totals more than $685 million.

Following the news of the merger, Tilray’s stock rose more than 21% the same day. Once the reverse-merger is finalized, Aphria shareholders will own 62% of the outstanding Tilray shares. That is a premium of 23% based on share price at market close on the 15th. Based on the past twelve months of reports, the two companies’ revenue totals more than $685 million. About two weeks ago, Aphria closed on their $300 million acquisition of Sweetwater Brewing Company, one of the largest independent craft brewers in the United States. Sweetwater is well known for their 420 Extra Pale Ale, their cannabis-curious lifestyle brands and their music festivals.

About two weeks ago, Aphria closed on their $300 million acquisition of Sweetwater Brewing Company, one of the largest independent craft brewers in the United States. Sweetwater is well known for their 420 Extra Pale Ale, their cannabis-curious lifestyle brands and their music festivals.