Part One of this series took a look at how the regulated cannabis market can only be understood in relation to the previous medical market as well as the ongoing “traditional” market. Part Two of the series describes how regulation defines vertical integration in California cannabis, and conversely, how vertical integration can address some of the problems that the regulations create. But first:

A Grain of Salt

Take the conventional wisdom about vertical integration with a grain of salt. Expected benefits may not materialize under the current circumstances:

- Overall, the business environment is highly challenging due to extensive regulation, over taxation, insufficient retail capacity and competition from the “traditional” market. As a result, integrating businesses upstream or downstream may mean capturing losses, not profits.

The three major types of cannabis activity span three major industrial sectors: raw materials (i.e., cultivation), manufacturing and service (distribution, testing and retail). As a result, a vertically integrated company needs to carry out very different types of activity, which require very different types of core competencies, equipment and facilities.

The three major types of cannabis activity span three major industrial sectors: raw materials (i.e., cultivation), manufacturing and service (distribution, testing and retail). As a result, a vertically integrated company needs to carry out very different types of activity, which require very different types of core competencies, equipment and facilities.

- Developing core competencies is especially challenging because each of the major cannabis sectors is still evolving.

- Realizing the benefits of vertical integration requires an additional core competency in cross-sector operations.

Regulations Define the Supply Chain

California’s regulations define the cannabis supply chain by defining both the individual links (licensees) and the relationships between those links. Therefore, an understanding of vertical integration must be grounded in an understanding of the underlying regulatory definitions.

The regulatory definition of each link is extensive. For example, each licensee is tied to a specific facility, and must have its own procedures for production, inventory control, security, etc. When the links are strung together, this definition tends to preserve operational redundancies, and impede operational integration.

The regulatory definition of each link is extensive. For example, each licensee is tied to a specific facility, and must have its own procedures for production, inventory control, security, etc. When the links are strung together, this definition tends to preserve operational redundancies, and impede operational integration.

Overall, the relationships between the links are primarily defined in terms of preserving the chain of cannabis custody. On top of that, regulations define very specific (and very consequential) links between certain licenses, as discussed below.

A Taxonomy of Links

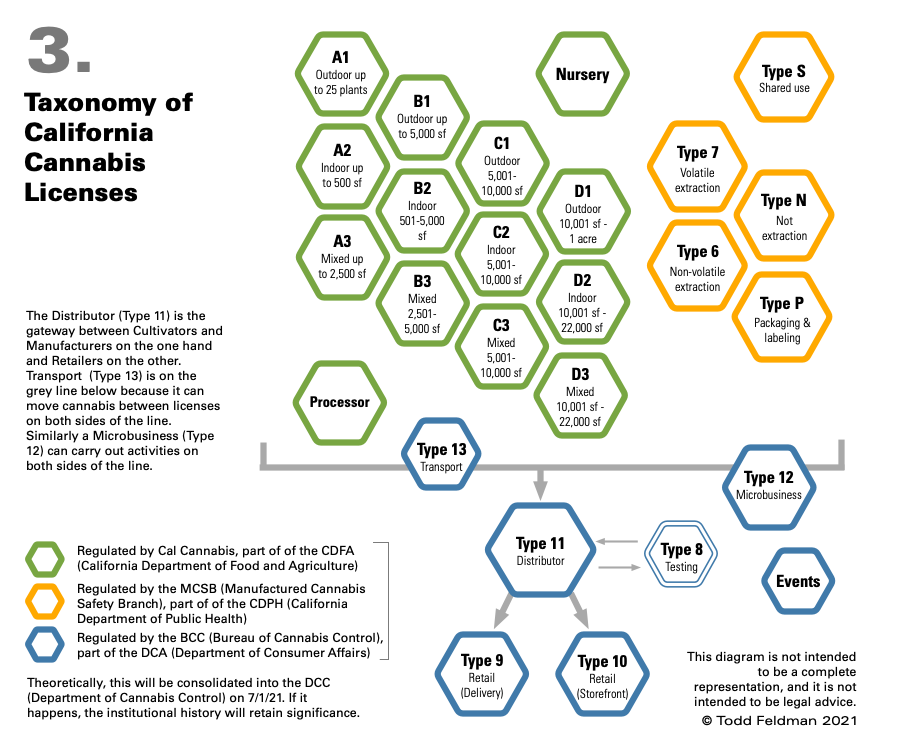

There are currently 26 types of cannabis license in California, 25 of which can be vertically integrated:

- Cultivation – 14 licenses, including 4 sizes each for Indoor (up to 22,0000 sf), Mixed Light (up to 22,000 sf) and Outdoor (up to 1 acre), as well as Nursery and Processor (drying, trimming and packaging/labeling). Note that cultivation licenses are the only licenses that restrict the scale of activities.

- Manufacturing – 5 licenses, including volatile extraction, non-volatile extraction, everything but extraction (i.e., infusion) and packaging/labeling.

- Testing (Type 8), for testing cannabis according to state standards prior to sale. The owner of a testing license cannot own any other type of license.

- Distribution (Type 11), acts as the gateway between cultivation and manufacturing on the one hand, and retail on the other. The distributor’s gateway status is entirely an artifact of regulation – cannabis must be officially tested before it is sold to a consumer, and only a distributor can order the official test. All products must stay in a “quarantine” area at the distributor until they pass testing. Products that fail testing must be destroyed if they cannot be remediated.

- Transport (Type 13), which can move cannabis between licensees (with a narrow exception). This license does not allow for official testing.

- Storefront Retail (Type 9), which is the best license to have, and the hardest one to get.

- Delivery Retail (Type 10), for delivery services that are subject to the vagaries of software platforms and the intransigence of local authorities.

- Microbusiness (Type 12), which allows the licensee to carry out cultivation (up to 10,000 square feet), non-volatile manufacturing, distribution and retail.

- Event Organizer

Self-Distribution – A Case of Useful Integration

You may gather from the previous section that shoving a gratuitous and mandatory distributor into the middle of the supply chain creates problems for cultivators and manufacturers. Savvy operators solve this problem by getting a distribution license. This allows the cultivator or manufacturer to:

- Pick the time and place for the testing of its cannabis products.

- Avoid paying someone else for the storage of cannabis products as they await test results or purchase.

- Reduce transport costs (particularly if the distributor is near the other operations).

- Sell directly to retailers.

The bottom line is that vertical integration in California cannabis is useful as a means to an end, as opposed to an end in itself. Therefore, cannabis operators should carefully consider how vertical integration will benefit their core business before incurring the risks and expenses associated with an additional license.

This article is an opinion only and is not intended to be legal advice.