Five states voted on adult-use cannabis legalization. These results increase the number of states that have legalized cannabis for adult-use from 19 to 21. Similar ballot measures failed, however, in Arkansas, North Dakota and South Dakota. The continued expansion of legalized cannabis at the state level, combined with President Biden’s recent initiation of an administrative process to review expeditiously how cannabis is scheduled under federal law, is likely to increase pressure on Congress and the rest of the federal government to either decriminalize or legalize cannabis under federal law.

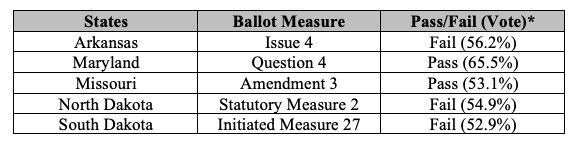

Here is a snapshot of the cannabis-related election results:

November 2022 Cannabis Referenda Results

Maryland

On November 8, 2022, Maryland voted to pass Maryland Question 4 (the Marijuana Legalization Amendment), by a margin of 65.5% to 34.5%. Maryland Question 4 amends the Maryland Constitution to add a new article, Article XX, which authorizes adults 21 years of age and older beginning in July 2023 to use and possess cannabis, and directs the Maryland legislature to pass laws for the use, distribution, regulation, and taxation of cannabis within the state.

Maryland legalized medical cannabis in 2014.

Interestingly, unlike most other ballot measures, Maryland Question 4 actually originated from the Maryland legislature. On April 1, 2022, the state legislature sent implementing legislation that was contingent upon the approval of the Marijuana Legalization Amendment to Governor Larry Hogan’s (R) desk. House Bill 837 (HB 837) was passed by the state House on February 25, 2022, by a vote of 92-37. The state Senate passed an amended version on March 31, 2022, by a vote of 30-15. The House concurred on April 1, with a vote of 89-41. Governor Hogan decided not to sign or veto the bill, allowing it to take effect upon approval of the amendment.

HB 837 temporarily expands decriminalization from January 1 to June 30, 2023. It decriminalizes the possession and use of up to 1.5 ounces of cannabis with a civil fine of up to $100. Before the passage of the Marijuana Legalization Amendment, the decriminalized amount was 10 grams. It also reduces the penalty for possession of more than 1.5 ounces but not exceeding 2.5 ounces to a civil fine of up to $250.

Beginning July 1, 2023, HB 837 legalizes the personal use and possession of up to 1.5 ounces or 12 grams of concentrated cannabis for individuals 21 years of age or older. It also legalizes the possession of up to two cannabis plants. It changes the criminal penalties for persons found possessing cannabis under the age of 21. The bill also automatically expunges convictions for conduct that is now legal, and individuals serving time for such offenses will be allowed to file for resentencing.

Beginning July 1, 2023, HB 837 legalizes the personal use and possession of up to 1.5 ounces or 12 grams of concentrated cannabis for individuals 21 years of age or older. It also legalizes the possession of up to two cannabis plants. It changes the criminal penalties for persons found possessing cannabis under the age of 21. The bill also automatically expunges convictions for conduct that is now legal, and individuals serving time for such offenses will be allowed to file for resentencing.

The bill also requires specific studies on the use of cannabis, the medical cannabis industry, and the adult-use cannabis industry. It also establishes the Cannabis Business Assistance Fund and the Cannabis Public Health Fund.

The Marijuana Legalization Amendment does not establish any licensing or regulatory framework for adult-use cannabis sales.

Missouri

On November 8, 2022, Missouri voters passed constitutional Amendment 3 by a margin of 53.1% to 46.9%, legalizing the purchase, possession, consumption, use, delivery, manufacture, and sale of cannabis for anyone over the age of 21. The law also imposes a 6% state tax on all cannabis sales and allows local governments to impose an additional tax of up to 3%. The law will go into effect December 7, 2022.

Missouri legalized medical cannabis in 2018.

Missouri legalized medical cannabis in 2018.

Under Amendment 3, private residences may contain no more than twelve flowering plants at one time, and both the plants and any cannabis produced by such plants in excess of three ounces must be kept in a locked space and not be made available to the public. Individuals may obtain a license to cultivate up to six flowering plants, six non-flowering plants, and six clones.

In addition, those individuals currently serving a sentence for certain cannabis-related offenses are now able to submit a petition for release from incarceration and/or expungement of the offense, and those previously convicted of certain cannabis-related offenses may petition for expungement.

Arkansas, North Dakota & South Dakota

Voters in Arkansas, North Dakota and South Dakota rejected adult-use legalization efforts in their respective states. Each state’s ballot measure would have allowed adults to possess up to one ounce of cannabis. In addition, among other things, Arkansas’ Issue 4 would also have expanded the state’s medical cannabis program to permit licensed businesses to sell to cannabis to adults; and North Dakota’s Initiated Statutory Measure 2 would have required the establishment and implementation of a program for the production and sale of adult-use cannabis by October 1, 2023.

Medical cannabis remains legal in Arkansas, North Dakota and South Dakota. Although there has been a trend in a number of states where legalization of adult-use cannabis follows prior legalization of medical cannabis and the establishment of a medical cannabis program in the state, that trend does not appear to hold true in these “red” states. For example, after North Dakota voters passed a ballot measure to legalize medical cannabis in 2016, they have now rejected ballot measures that would have legalized adult-use cannabis in both 2018 and 2022. In South Dakota, voters passed a ballot measure to legalize adult-use cannabis in 2020, which was later invalidated by South Dakota courts in response to a challenge brought by Governor Kristi Noem. Two year later, voter interest dwindled and a similar measure failed.

A Look Ahead to 2023

Oklahoma

On the horizon for 2023 is a second chance for Oklahomans to decide on State Question 820, which would legalize adult-use cannabis for individuals 21 years of age and older after the Oklahoma Supreme Court denied a chance for voters to decide on the measure this November.

Oklahomans for Sensible Marijuana Laws (OSML) petitioned State Question 820 for the November ballot on July 5th, submitting nearly 164,000 signatures one month in advance of the August 1st deadline. Despite the Secretary of State Brian Bringman’s office advising OSML that the counting and verification process for signatures typically takes 2 to 3 weeks to complete, the office took nearly seven weeks to certify that 117,257 signatures were valid – well over the required minimum of 94,911 signatures. The severe delay caused OSML to miss the August 26th deadline for the measure to complete a 10-day protest period, finalize the measure, and print State Question 820 on the ballot. The Oklahoma Supreme Court ruled on September 21, 2022 that the measure would have to be postponed until a future election. “At this point in time, SQ820 is not in full compliance. There is still a possibility of rehearing in two of the protests, which prevents this Court from fully resolving those objections in compliance with [state law]. That, in turn, prevents the Secretary of State and the Governor from taking their final steps in compliance with [state law].” Nichols v. Ziriax 2022 OK 76, ¶14.

On October 18, 2022, Governor J. Kevin Stitt issued an Executive Proclamation declaring a special election to vote on State Question 820 – a proposal to legalize adult-use cannabis, which will take place on March 7, 2023.