Bankruptcy is Not an Option

Bankruptcy courts do not provide protection to cannabis and cannabis-related businesses.Bankruptcy can be a very helpful tool for a distressed business. Bankruptcy allows a business to stop collection actions, discharge certain debts, cancel unfavorable contracts and provides breathing room to restructure the business.

What if your cannabis operation is struggling or failing – file for bankruptcy, right? Not so fast. Despite cannabis being legalized or decriminalized for certain activities at the state level, it remains illegal at the federal level. Therefore, the bankruptcy court will not provide protection to cannabis and cannabis-related businesses (CRB).

Alternatives to Bankruptcy

A State Court receiver may be the best alternative when bankruptcy is not an option.Enter the state court receivership. Receivership is an equitable remedy that is often employed as an alternative to a bankruptcy proceeding. A receivership can address business insolvency or can be a temporary remedy during legal proceedings between disputing business partners, with control of the enterprise hanging in the balance.

In either scenario, the court appointed receiver takes control of the business and must assess the posture of the business and determine the best path forward. The receiver’s options run the gamut from operating the company as is, restructuring operations to maximize profit or closing shop and liquidating the business as a whole or in pieces. The receiver has a fiduciary responsibility to determine the option that best satisfies creditors, similar to duties required of a trustee in a bankruptcy.

The importance of having a receiver well-versed in the cannabis industry cannot be overstated.Distressed cannabis companies are often prime candidates for receivership. Cannabis is a burgeoning industry with huge growth and profit potential. However, worlds have collided in the Green Rush, where business-minded individuals, often with little knowledge of cannabis, have partnered with individuals well-versed in cannabis culture, cultivation and consumption, but with little experience operating a business. Add a dash of complex state laws and regulatory drama in the form of the federal/state divide on legality, a dollop of fraud potential due to the largely all-cash nature of the business and you’ve created the perfect recipe for insolvency, litigation or both. In these often-chaotic conditions it is easy for a cannabis company to become unprofitable. A receiver can add significant value by stabilizing the business while the litigation proceeds or while developing a restructuring plan. In either case the goal of a receivership is to maximize the value of a business for the benefit of its stakeholders.

If you are considering restructuring options for your cannabis operation, a receivership can be an excellent choice. However, a cannabis receivership is not for the faint of heart. There are two significant areas that distinguish cannabis receiverships from receiverships involving non-cannabis businesses: First, the complex regulatory environment and second, banking. The importance of having a receiver well-versed in the cannabis industry cannot be overstated. Making a mistake in these areas can cause more harm than good.

Complex Regulatory Environment

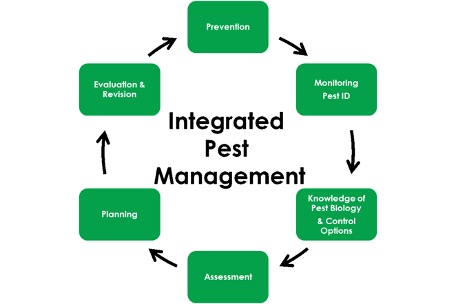

Cannabis operations are subject to a complicated regulatory framework that varies by state as well as by type of legalization (medical versus adult use cannabis). Receivers unfamiliar with the cannabis industry and the associated regulatory framework will be behind the curve on day one.

Upon appointment over a cannabis entity a receiver becomes responsible for the regulatory posture of that entity.Regulatory hurdles begin at the outset of a receivership. Although receivership is an excellent restructuring option for cannabis operators in distress, regulations surrounding the authorization requirements for those operating the business on a day-to-day basis (including receivers) vary by state. Some states, but not all, even have specific regulations for receiverships.

For example, the rules and regulations for cannabis operators in Colorado administered by the Colorado Marijuana Enforcement Division (MED) include provisions for receiverships. Specifically, the MED requires court appointees, including receivers, to register with the State Licensing Authority as Temporary Appointee[s] of the Court within seven days of appointment.

Similarly, Washington State cannabis regulations directly address receiverships. Specifically, Title 314 allows receivers or trustees to operate a licensed cannabis business, but the receiver must be qualified by the Washington State Liquor Control Board (LCB). Qualification requirements include active status on the LCB preapproved receiver list or submission of an application to serve as a receiver for a licensee within two days of appointment. Furthermore, to serve as a receiver of a Washington state cannabis licensee the receiver must meet residency requirements.

Conversely, the Arizona cannabis laws and rules do not specifically address cannabis receiverships. Nevertheless, Arizona does require anyone volunteering or working at a medical or recreational cannabis dispensary to be registered with the Arizona Department of Health Services as either a Dispensary Agent (DA) or a Facility Agent (FA). Therefore, a receiver appointed over a licensed cannabis business in Arizona must obtain the applicable registration upon appointment in order to take control of the licensed entity in a compliant manner.

The fun doesn’t stop after the initial appointment hurdles are cleared. The regulatory environment across the country is a patchwork of complex laws. States that have legalized or decriminalized cannabis on some level have instituted often complex rules surrounding the cultivation, manufacture, wholesale and retail sale of cannabis. Even seemingly simple concepts such as the definition of cannabis are not so simple in some states. For example, Massachusetts includes cannabidiol (CBD) in its definition of cannabis while Arizona does not.

Some states, like California, do not allow the sale of cannabis licenses. Other states, like Colorado, allow for the transfer of commercial cannabis licenses. In a turnaround situation it is particularly important to understand the options available to liquidate a licensee’s assets.

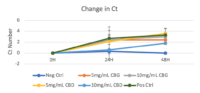

Similarly, many, but not all states have rules requiring cannabis product testing by accredited laboratories prior to retail sale. Most states require THC potency testing, while others (like California and Colorado) also require testing for pesticides and toxins. Conversely, testing for toxins and contaminates is voluntary in Florida. Product testing is expensive and time-consuming, and operators must have a comprehensive system in place to ensure compliant product is available for sale to retail and wholesale customers.

Even taxes are different for cannabis businesses. A receiver must understand and be able to manage a cannabis business in order to comply with and minimize taxes under the infamous 280e regulations of the U.S. tax code.

Upon appointment over a cannabis entity a receiver becomes responsible for the regulatory posture of that entity. Accordingly, the receiver must ensure that any regulatory deficiencies are identified and corrected in order to ensure compliant operation.

We’ve highlighted just a few of the myriad of regulatory concerns facing a receiver upon appointment. It is critical to engage a receiver who has experience working under the complex cannabis regulatory structure for your distressed cannabis operation.

Banking

One of the most important things a receiver does upon appointment is to identify and secure the assets of the entity in receivership, including cash. This normally involves opening a bank account in the name of the receivership entity that is controlled solely by the receiver and moving cash assets into the controlled account.

This typically ordinary task is not so easy with a cannabis operation. Because cannabis remains illegal under federal law, processing funds derived from the sale of cannabis (even sales that are legal at the state level) can be considered by the Department of Justice (DOJ) as aiding and abetting criminal activity or money laundering.A receiver must negotiate the complex banking regulations regarding cannabis businesses and effectively manage the large amounts of cash, which may not be bankable.

The Financial Crimes Enforcement Network (FinCen) issued guidance in 2014 that cleared the way for financial institutions to service canna-businesses (2014 Guidance). The 2014 Guidance requires financial institutions who choose to provide services to CRBs to design and implement a thorough customer due diligence review that includes, in part, analyzing the licensing of the entity, developing an understanding of the business operations of the entity, and ongoing monitoring of the entity. In addition, financial institutions are required to file a Suspicious Activity Report (SAR) for every transaction they process for a CRB, should they choose to accept the business.

While this is a positive step forward, it is a heavy compliance burden that comes at a cost. Naturally, compliance costs incurred by banks to service cannabis operators are passed on to the customer; fees of $2,500 per month per account are not uncommon. The high compliance costs, coupled with the significant regulatory risk, keeps most banks out of the cannabis market; thus, making it hard, but not impossible, for a receiver appointed over a cannabis operation or CRB to obtain banking.

While banking options do exist, the reality is that most canna-businesses operate on a cash basis. Distressed cannabis operations may not have the cashflow to afford banking services, at least at the outset of a receivership. Further compounding the banking problem, some banks that are open to cannabis are not open to receiverships, further limiting banking options.

A receiver therefore must be prepared to quickly secure all cash assets of the receivership entity and ensure appropriate internal controls are in place to control cash on an ongoing basis.

Cannabis has been legalized or decriminalized in a majority of U.S. states but remains illegal at the federal level. Therefore, federal bankruptcy protection is not generally an option available for a distressed canna business. However, not all is lost because state receiverships offer an excellent restructuring option for distressed cannabis operations.