The Agriculture Improvement Act of 2018 legalized the growth, sales and transportation of industrial hemp across state lines. Although it looks identical to other types of cannabis, this cannabis plant contains less than 0.3 percent THC, and can be used to make building insulation, beauty products, car dashboards and more. Most significantly for farmers, it can serve as an ideal rotational crop because of its ability to reduce soil toxicity.

Until this update to the Farm Bill, hemp was considered a controlled substance and few U.S. farmers were granted rights to plant and harvest it. Now, the agricultural commodity is expected to raise the crop’s already growing GDP to that of liquor and beer sales and some estimate it should reach $20 billion in as little as five years.

Agribusinessesand farmers alike will now be looking to secure processors and other commodity buyers ahead of planting industrial hemp and purchasing the necessary equipment for its harvest. Because hemp can be grown in any climate, it may be especially attractive to tobacco growers and dairy farmers who have been less profitable as of late.

Now that it’s been legalized, what’s the risk?

As more agribusinesses and farmers look to confirm viability of industrial hemp growth, potential liabilities will surface. The 2018 Farm Bill left many questions unanswered. Here are a just a few FAQs:

Question: Can I just add hemp to my crop rotation, or is additional insurance required?

Answer: The standard multi-peril crop insurance policy DOES NOT provide coverage for planting hemp, or endorsements for its storage and transportation- yet. Instead, industrial hemp must be insured on separate private policies for: harvest, extreme weather and crop storage and transportation. There’s a strong push to get industrial hemp into the federal crop insurance program as early as crop year 2020. As hemp planting, harvesting, storage and transportation become more understood and predictable, new policy options will likely become available. Inquire about new coverage options at your next annual renewal.

Q: How will the FDA regulate industrialized hemp?

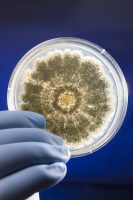

A: The FDA will develop rules and regulations on industrial hemp throughout 2019, and will be ready for rollout during the 2020 crop year. Because it’s impossible to distinguish a cannabis plant with THC from an industrial hemp plant in the field, crop lifecycle testing and documentation will likely be required. The question remains if this testing and documentation will be incumbent on the farm/agribusiness, or FDA agents. Some states are further along in this process and have already hired testing and compliance officers.

Q: How can farmers ensure that the THC content of their plants does not exceed .3%?

A: Farmers must have a contingency plan for monitoring their hemp’s THC content which should include employing a seasoned agronomist who can institute controls, keep plants properly hydrated and create a plan to maintain optimal THC levels. In the heat of the summer, THC levels typically remain low, but rise with cold and rain. Should there be a local cold spell, high rainfall, or if the hemp plant was seeded late in the season and the harvest runs into the fall, THC levels could rise quickly. When this happens, farmers will have to chop down the plant to control the level and harvest the plant’s flower before its next THC test.As with any emerging market, there is still a lot of doubt surrounding the growth and sales of industrial hemp, as many risks are unknown.

Q: Can I transport hemp across state lines to a processor in another state?

A: On paper, industrial hemp is legal across all 50 states, and therefore can be transported across state lines and sold as any other commodity. In reality, though, hemp is undistinguishable from cannabis to the naked eye, and therefore, shipping an entire biomass directly from the field across state lines has a good chance of being confiscated.

When hemp is confiscated on the side of the road – even if it is eventually returned – there could be significant lag in delivery, storage is uncertain and quality control can’t be maintained. Alternatively, farmers are now shipping their hemp in smaller, unmarked loads, which is forcing them to hold onto product for longer than usual.

As with any emerging market, there is still a lot of doubt surrounding the growth and sales of industrial hemp, as many risks are unknown. On the flip side, industrial hemp offers small farmers and agribusinesses alike an unprecedented opportunity to get in at the ground floor of a new crop. If you do, make sure to work with your insurance broker to secure proper coverage immediately.